Simple maths shows 2x more per-user capacity compared with interim satellite, but only 0.7x more data allowance is proposed.

After revealing the proposed restrictions and fair use policies to help manage traffic and congestion on nbn Satellite service, some residents have taken to Whirlpool Broadband Forums to express their concerns. The primary concern being that a 75 GB 4-week rolling average limit doesn’t translate to 75 GB of “anytime data”.

According to the draft Fair Use Policy, nbn will — in addition to limiting the maximum usage per service to 75 GB on the standard CVC Class 0 — also limits the ISP-wide 4 week rolling average download and upload during peak periods (from 7am to 1am the following day, local time). Currently, the base CVC Class 0 is proposed to be 15 GB download and 3 GB upload.

This means, if the Fair Use Policy isn’t altered before the final satellite product release, a service provider would have to either carefully balance a number of lower capacity plans with higher capacity plans to maintain an average of 15GB, or offer one plan that provides close to 15GB with around 40GB of off-peak data up for grabs for all users.

| CVC Class | AVC+CVC Fee (25/5 Mbps)* |

User data cap (4-week rolling avg) |

Peak Period Download (ISP 4-wk average) |

Peak Period Upload (ISP 4-wk average) |

|---|---|---|---|---|

| 0 | $27.00 | 75 GB | 15 GB | 3 GB |

| 1 | $45.00 | 100 GB | 20 GB | 4 GB |

| 2 | $67.00 | 150 GB | 25 GB | 5 GB |

Realistically, however, we can expect RSPs to oversell slightly given the 15 GB limit is averaged across the ISP using the assumption that a portion of their users will not reach the 15 GB limit.

Comparing increased capacity with Fair Use Policy

But just how fair is this 15 GB / 3 GB averaged limit being proposed by nbn? Let’s see how it compares with the current nbn Interim Satellite Service and nbn Fixed Wireless network.

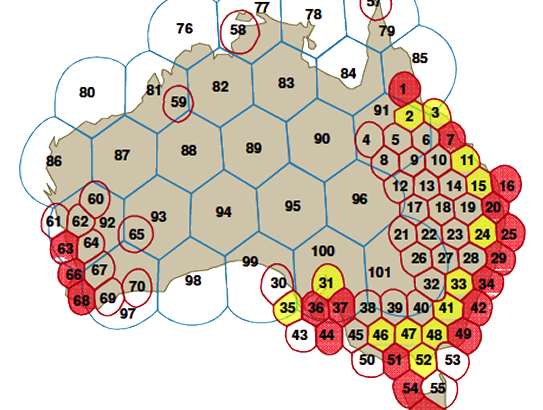

Per-user allocated capacity

Firstly, let’s check how much satellite capacity is expected to be assigned to an end user. Since nbn imposes minimum customers-to-CVC (AVC-to-CVC) ratio (so RSPs can’t hog virtual capacity), we can calculate these numbers by dividing the CVC capacity by the maximum and minimum customers.

As seen above, this averages out to be around 125 kbps per user on CVC Class 0, 145 kbps per user on CVC Class 1 and 190 kbps per user on CVC Class 1.

| CVC Class | Maximum CVC (Mbps) | Average per-user capacity allocation (kbps) |

|---|---|---|

| 0 | 475 | 125 |

| 1 | 550 | 145 |

| 2 | 735 | 190 |

In comparison, the dimensioning of nbn‘s Fixed Wireless network allocates roughly 500 kbps per-user and 40 kbps on the current nbn Interim Satellite Service (ISS). In light of this, let’s compare the percentage difference in capacity on the various CVC Classes compared to Fixed Wireless and ISS:

| CVC Class | Per-user capacity (kbps) | % of ISS capacity (40 kbps) | % of FW capacity (500 kbps) |

|---|---|---|---|

| 0 | 125 | 313% | 25% |

| 1 | 145 | 363% | 29% |

| 2 | 190 | 475% | 38% |

So, the standard CVC Class 0 product has roughly 2 times (or is 313% of) per-user allocated capacity on the Interim Satellite Service. It is also roughly a quarter of the capacity on the NBN Fixed Wireless network. How do the Fair Use Policies for the ISS and Fixed Wireless compare numerically to the proposed Long Term Satellite?

Fair use policies

Interim Satellite Service: nbn‘s fair use policy for the Interim Satellite Service is structured similarly to the proposed Long Term Satellite policy. Currently, the cap at a per-AVC (or customer) basis is 50GB. 313% of that would bring it to ~150GB, rather than the 75GB proposed.

But as we have said, this limit means little given the bulk of downloads generally occur during peak time. While nbn doesn’t have a peak time average limit on the ISS, the company has mandated an ISP-wide averaged 9.7 GB download limit on a 4-week rolling average basis. For this model, let’s assume that ~90% of traffic occurs during peak time — coming to an estimated ISP-wide averaged 8.7 GB download limit on a 4-week rolling average basis. 313% of that would bring us to ~27.6 GB, compared to the 15 GB proposed.

In summary, while per-user assigned capacity has increased by around 2x compared with the ISS — data limits in the fair use policy have only increased by a mere 0.72x.

Fixed Wireless: nbn‘s fair use policy for the Fixed Wireless network is straightforward. RSPs must maintain, on average across their user base, less than 200GB download (let’s consider download only). Like the ISS, there are no limits on peak/off-peak usage… but let’s assume that 90% of traffic is carried during peak time (meaning ~180 GB download). If we take 25% of the Fixed Wireless fair use policy, we get 45 GB per month of peak time data per month.

Having calculated that, however, it’s important to remember that Fixed Wireless is a fundamentally different product. Given it has far more capacity compared with any satellite product, there is more room to wriggle when it comes to the fair use policy limits. However, for completeness sake, while the per-user capacity on the LTS is around 25% of Fixed Wireless — the data limits in the fair use policy are a mere 8.3%.

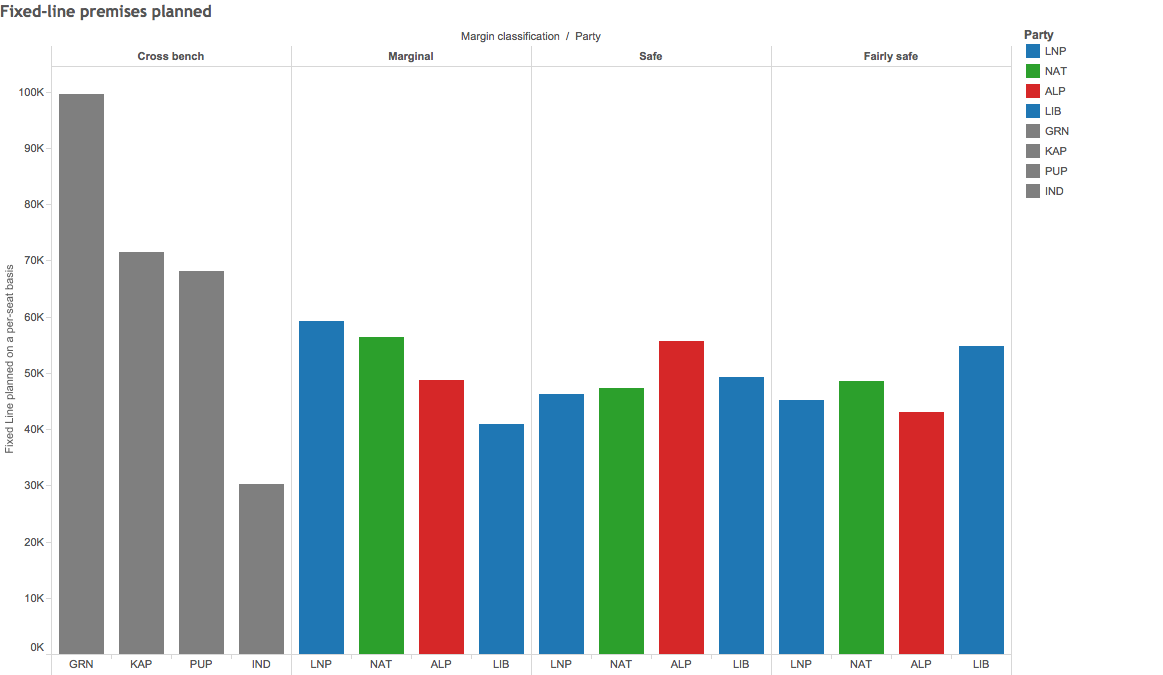

| CVC Class | % of ISS capacity | % of ISS FUP (1) | % of ISS FUP (2) | % of FW capacity | % of FW FUP (1) |

|---|---|---|---|---|---|

| 0 | 313% | 172% | 150% | 25% | 8% |

| 1 | 363% | 230% | 200% | 29% | 11% |

| 2 | 475% | 245% | 300% | 38% | 17% |

Table: % of per-user allocated capacity when compared with ISS capacity and FW capacity, and compares this with the % of the various data allowances set in proposed Fair Use Policy

(1) refers to the ISP-wide 4-week rolling average, (2) refers to the per-AVC cap (50 GB on ISS, not applicable for FW)

The summary

nbn appears to be very conservative when it comes to allocating data allowances on the Fair Use Policy. Comparing to the Interim Satellite Service, per-user capacity has increased by between 2x to ~3x (depending on which CVC Class you choose). However, ISP-wide peak-time data allowance only increases by between ~0.72x to ~2.5x (again, depending on CVC Class being compared).

As the writer doing the analysis, I believe there is scope for nbn to increase limits currently proposed in the draft Fair Use Policy. Ideally, if service providers can buy two times more CVC capacity compared with what they can do on the ISS — they should be able to offer customers around the same amount more data… but I’m not going to sit here and pretend that using capacity can be calculated using simple maths.

Real networks are far more complex beasts, and simple calculations do not necessarily reflect how real networks behave. But I believe a simple scale projection, as I’ve done above, would aid the public gaining some perspective on how little data caps have increased in comparison to the new satellite’s extra capacity.

All is not lost:

Some service providers who are helping nbn test their satellite systems before the Q2 2016 launch are actively working with nbn to get the best Fair Use Policy possible. In the words of Paul Rees, the managing director at SkyMesh:

“We’re doing all we can to get the best FUP for customers that provides decent Data Allowances that don’t wreck LTSS performance at peak times.”

“The FUP hasn’t been set in stone yet, those numbers are just part of a draft document. So let’s have some calm, and save the ‘going nuts’ until the FUP has been formally decided.”

Wise words, Paul. We wish you all the best in your pursuit.