With almost no competition to incentivise an upgrade to its network, can NBN’s monopoly Multi-Technology Mix keep up with user demands or will it become Telstra 2.0?

Infrastructure Australia released it’s “Australian Infrastructure Plan” report today. It’s contents are not exclusively about the National Broadband Network, however, it made a number of recommendations to the Government suggesting that the NBN should be privatised in the medium term.

A bit of background: the fibre monopoly

Since the conception of the National Broadband Network, there had always been a plan and provision to sell company once the rollout is complete. With the original “full fibre” plan envisaged by the then-Labor Government, selling or not selling the fibre network at completion wouldn’t materially affect competition.

Fibre at the premises level is a natural infrastructure monopoly. Much like how water supply companies do not build competing sets of pipes for competition, fibre is effectively a pipe with limitless upgrade opportunities by simply “swapping out the equipment at each end”. It is vastly inefficient to duplicate networks for the sake of competition, and the Optus and Telstra HFC “war” in the 90s was an excellent example of how broadband infrastructure competition can fail.

There is a case for small amounts of network duplication in inner metropolitan areas. However, it becomes hard to compete (at least within the fixed-line space) with a network that’s already built to the scale that NBN would have.

Selling, or even long term (99 year) leases of the fibre network based on geographical areas would have made sense. Like water companies, telco infrastructure entities wouldn’t spend too much time duplicating each other’s network. Upgrading networks to user demands would incur minimal capital expenditure, as it’s a matter of swapping equipment at two ends. Competition will continue to exist, but only in the retail/service delivery component of the network by Internet Service Providers.

The Multi-Technology Mix

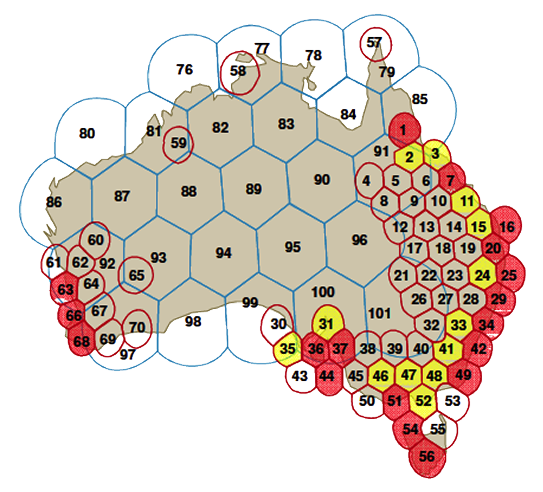

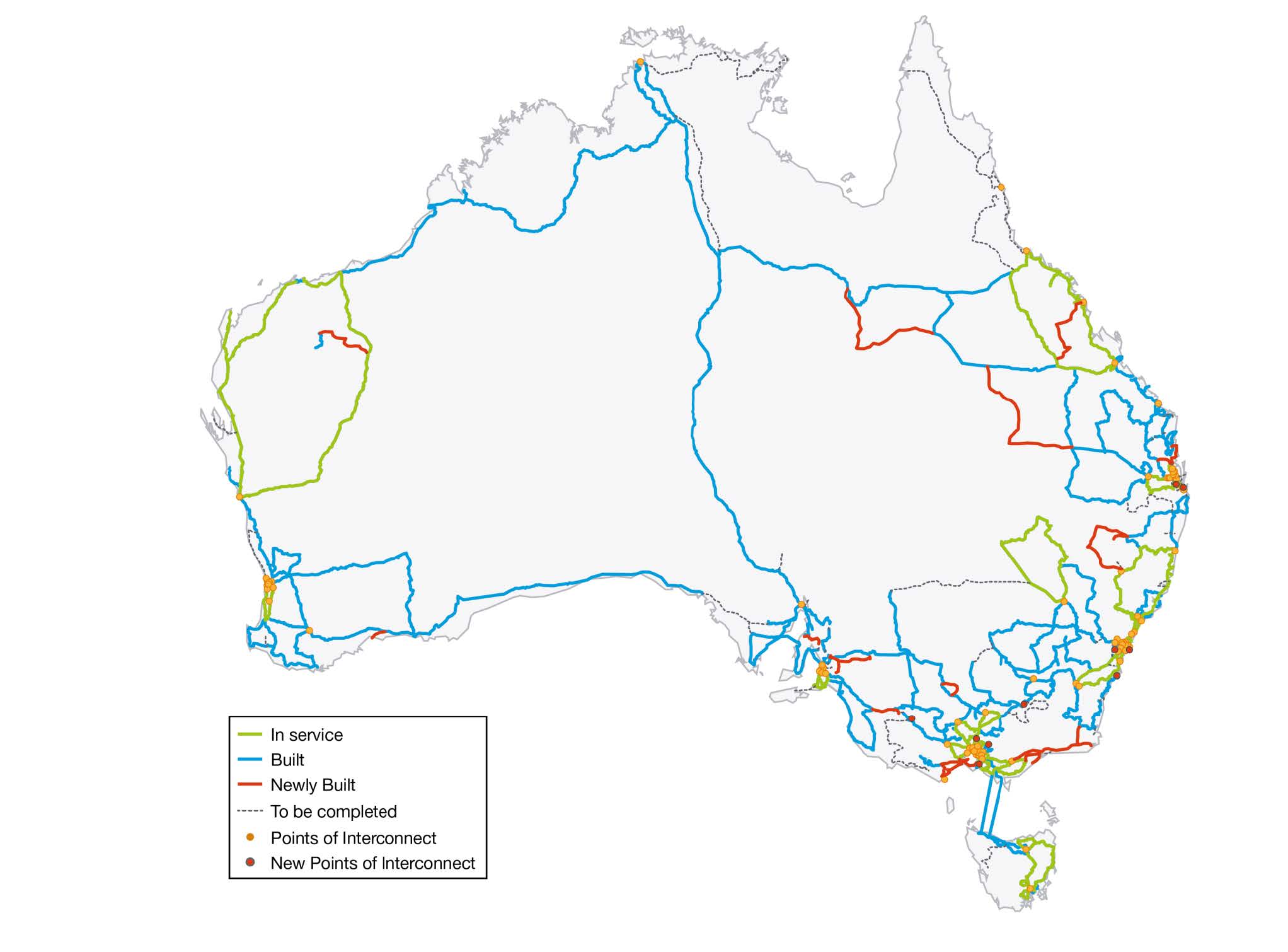

But things changed. If you haven’t noticed, the NBN is no longer rolling out fibre to the majority of premises. The Coalition Government’s policy of a Multi-Technology Mix fixed-line network creates new challenges policy makers in the future will need to deliberate carefully before pressing sell in parliament.

On the upside, a Multi-Technology Mix is an effective way to drive infrastructure competition. However, it doesn’t work when it’s being built by a single entity — especially not a Government-owned enterprise.

No incentive to upgrade, unless split up and privatised

As a monopoly, investing large sums of money on upgrading technologies like VDSL2 over copper where upgrade paths is not as simple as “swapping out equipment” presents an ongoing burden for the NBN company. As user bandwidth demand grows, many telecommunications companies would upgrade and extend their networks to meet user demand. Or else, they would risk a competitor coming in to take over their market share. That’s what happens in areas with healthy infrastructure competition — such as Hong Kong.

But like Telstra before it, NBN wouldn’t have a business case to upgrade its networks — even if user demands skyrocket. The company would stand to lose money (at least in the short-term) by investing to upgrade its network, while it would keep a steady revenue if it just maintained the network as it is and not upgrading at all! Civil costs to push fibre out further into the field to meet user demand isn’t cheap, especially when it’s done in successive truck rolls (which is what the current policy is).

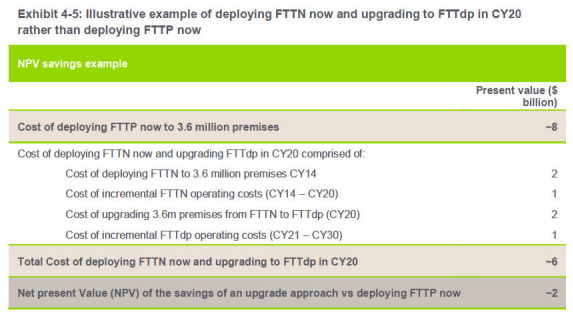

We can say that the current NBN policy focuses on short-term policy objectives — lowering the short-term capital expenditure costs, while risking medium to long-term operation costs — in other words, leaving it for policymakers of the future to deal with.

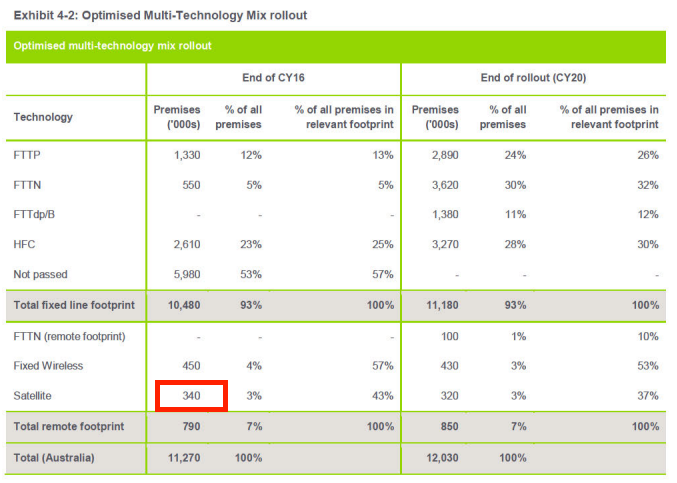

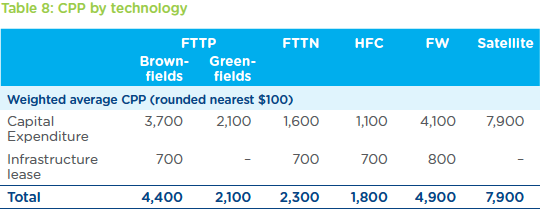

Privatising the Multi-Technology Mix by its technologies would make sense — provided the necessary regulatory instruments were put in place. Consider privatisation by splitting the NBN into a FTTx, HFC and Wireless/Terrestrial entities. These three entities could lend themselves to infrastructure competition in areas where there is sufficient network overlap. In metro areas for example, failure to upgrade the copper-based VDSL2 solution used by the FTTx entity would see the threat of an adjacent HFC footprint grow to meet user demand (and vice versa).

In regional and rural areas, the viability of infrastructure competition is not immediately obvious. Improvements in fixed wireless technologies could threaten the market share of the FTTx entity, but the fixed wireless network would need to grow substantially to be of real competition. In addition, wireless and terrestrial (satellite) solutions tend to be more expensive. So is it possible to create healthy competition, or would those areas have to rely on Government subsidies to promote upgrades?

Even if competitors are identified, each of these entity would need to have equal opportunity to grow its footprint into their competitor’s existing footprint. Having equal access to things like duct and pipe, Tier 1 and Tier 2 facilities, power and potentially many more aspects is crucial before any privatisation goes ahead.

Then there’s the issue of vertical integration

Looking at the current telco market in Australia, obvious candidates with enough capital for purchasing parts of a privatised NBN would be Telstra, Optus, the TPG Group and the M2 Group. Companies like Nextgen or Vodafone could still take a share.

But all these companies I’ve listed, bar Nextgen, already hold a retail front: Telstra, Optus, TPG and Vodafone are obvious by name. M2 owns Dodo and iPrimus.

Currently, the unique nature of NBN is that it is entirely wholesale only with no vertical integration, driving substantial retail competition in the service provider front. In my opinion, this needs to stay as is. Infrastructure companies should stay structurally separated from its retail front to ensure innovation within the “service” sector and ensures equal pricing regardless of who owns the network.

Conclusion

In a privatised world without a ubiquitous network of natural monopoly (like fibre), the only way networks will meet user demand is by infrastructure competition. Infrastructure competition requires network duplication (or at least the threat of) to stimulate investment to upgrade. So the question is: do we want this duplication? Isn’t it blindingly inefficient to have networks that do the same thing being built two or three times over just to keep with user demand?

I think we’ve put ourselves in another telecommunications policy nightmare in Australia. Time and time again, successive Governments — in their short sightedness — have failed to realise the consequences of their policy decisions. The NBN was meant to solve the issue of a lack of infrastructure investment that resulted from the privatisation of Telstra. It still could, but potentially at the cost of inefficient network duplication.

Yes, I’d still argue that a Fibre to the Premises model would have been the ideal model. It would have made privatisation easier, it would have been far more elegant. But what’s done is done.

Some would argue it’s a good thing. Infrastructure competition could work well for companies who have substantial capital while also owning large amounts of existing network assets.

Currently, TPG is the disrupter in the market. The rollout of inner-city Fibre to the Basement network is a good example of what healthy infrastructure competition could look like.

So yes, in conclusion, if done correctly — splitting and selling the NBN is probably the best way forward for Australia. But as Malcolm would say, “it’s not the way we would have done it”.

What do you think?