Following a map update yesterday, NBN Co has removed approximately 58 thousand premises that were previously slated for a Fibre to the Premises rollout from its rollout map.

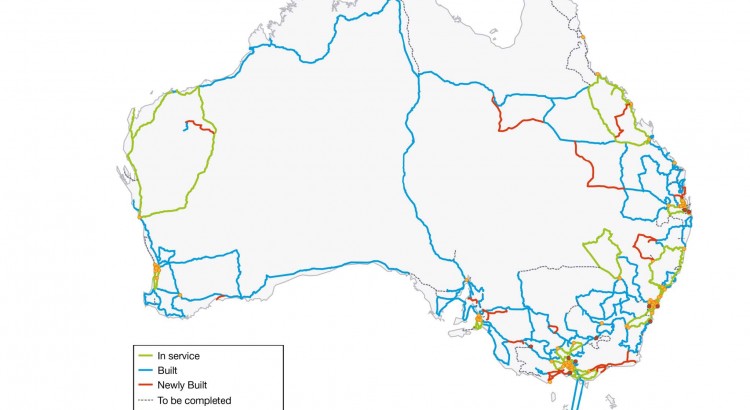

These premises, spread across 22 Serving Area Modules (SAMs) in NSW, VIC, QLD, SA and WA, were all in the Build Preparation phase where Telstra’s pit and pipe remediation works commences and detailed designs of the SAM being finalised with NBN Co’s construction partners.

The majority of these SAMs are covered by Telstra’s or Optus’ HFC networks, which NBN Co is expected to acquire, upgrade and integrate into the National Broadband Network as part of their so-called “Multi-Technology Mix” rollout strategy. It is expected that most of these areas will now be delayed until the HFC deals are finalised and rollout commences.

However, there are also some areas such as Dubbo (2DBB-06) that are not covered by the HFC networks but were still removed from the map.

Update 15/04/15: According to Daily Liberal, 2DBB-06 was delayed due to an “over ambitious” rollout sequencing by NBN Co.

A full list of SAMs removed, their coverage localities and the approximate number of premises covered by each SAM can be found below. Dave Cooper has also collated and compared the maps of the areas removed. He has tweeted GIFs of the before and after SAMs removed. They can be found below the opinion piece 🙂

| SAM ID |

Localities |

Approx. # of Premises |

| 2BLK-08 |

Doonside |

2,700 |

| 2DBB-06 |

Dubbo |

2,400 |

| 2CAM-03 |

Campsie |

2,700 |

| 2CAM-04 |

Campsie, Belfield |

2,800 |

| 2HOM-05 |

Strathfield South, Belfield |

2,800 |

| 2HOM-06 |

Greenacre |

2,600 |

| 2LIV-06 |

Warwick Farm |

2,600 |

| 2LIV-09 |

Moorebank |

2,600 |

| 3FSR-02 |

West Footscray, Footscray |

2,400 |

| 3FSR-11 |

Footscray |

2,400 |

| 3KEY-06 |

Keysborough |

2,600 |

| 3WER-04 |

Wyndham Vale |

2,400 |

| 4AAR-04 |

Sunnybank Hills, Runcorn |

2,800 |

| 4AAR-05 |

Karawatha, Runcorn, Stretton, Calamvale |

2,800 |

| 4APL-05 |

Carseldine, Bridgeman Downs |

2,400 |

| 4BDB-04 |

New Chum, Redbank, Collingwood Park |

1,900 |

| 4NDG-04 |

Nundah, Northgate |

3,700 |

| 4NDG-05 |

Wavell Heights, Nundah |

2,900 |

| 4NDG-06 |

Virginia, Wavell Heights, Northgate |

2,900 |

| 5MOD-08 |

Redwood Park, Modbury Heights |

2,300 |

| 6APP-05 |

Winthrop |

2,600 |

| 6SPT-05 |

Como |

2,700 |

| Total |

58,000 |

Opinion: the good, and the bad

(opinion) It’s not the first time that NBN Co has removed areas from the rollout map, and it won’t be the last. But it’s another significant reduction of premises covered by the Fibre network.

The good news is that NBN Co is deciding to make better use of tax payers money in achieving its expectations (as outlined in the Statement of Expectations, which only requires min. 25 mbps, remember!). Once DOCSIS 3.1 is rolled out, the HFC network upgrade will be vastly better than current HFC services and indeed — should be able to deliver speeds comparable to the current FTTP network.

The sad news is that you won’t get fibre (but it’s okay!) and you probably won’t get faster internet for some time yet… at least until the HFC deal is finalised and the upgrades are done.

It is disappointing to see NBN Co add these areas, knowing the HFC deal was ahead, then backtrack and remove these areas silently. No doubt, there will be many disappointed people around Australia that their beloved fibre connections will no longer come to them.

I believe that, as hard as it may be, NBN Co has a role in informing these communities that they were removed from the map for a reason and not to fear. To have them on as “build preparation has commenced”, then suddenly remove them because of a change in policy that was known months in advanced will only cause confusion and angst in the community.

(more…)