It’s not that there’s no demand, it’s that NBN’s pricing model makes it impossible for providers to put any gigabit services to market.

There’s a common misconception that there is “no demand” for gigabit Internet services in Australia. After all, if there’s no actual customer taking up a gigabit service on the NBN — how can there possibly be any demand?

Apparently, despite providers around the world actively and successfully selling gigabit connections to speed-hungry residential customers, Australians are so “agile” and “innovative” that they see no need for higher speed connections that our counterparts in the rest of the developed world seek for.

At least that’s what the latest spiel from The Australian may lead you to think.

Of course, the paper is absolutely correct in saying that the only NBN customers on gigabit connections are “trial” connections by service providers. But what the article neglects on is the context: why Australians are always seemingly so special compared with the rest of the world. A inhibitive pricing model.

Where did the pricing go wrong?

I’ve written extensively about the issues with the NBN Connectivity Virtual Circuit (CVC) pricing model. Effectively, providers have to buy virtual bandwidth capacity (CVC) that’s shared across all^ the users from a single retail service provider (RSP).

If a provider buys only 100Mbps of CVC: at any point in time, the sum of all traffic across all users from that RSP will be capped at 100Mbps. It doesn’t matter if the provider has 50 x 100/40Mbps connection, the maximum the provider can transfer across all users is 100Mbps.

The problem is that it is set at an artificially high price to ensure revenue to the NBN company.

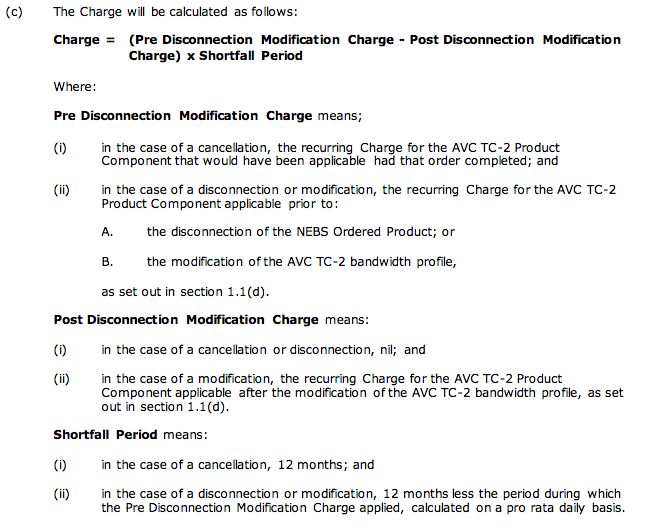

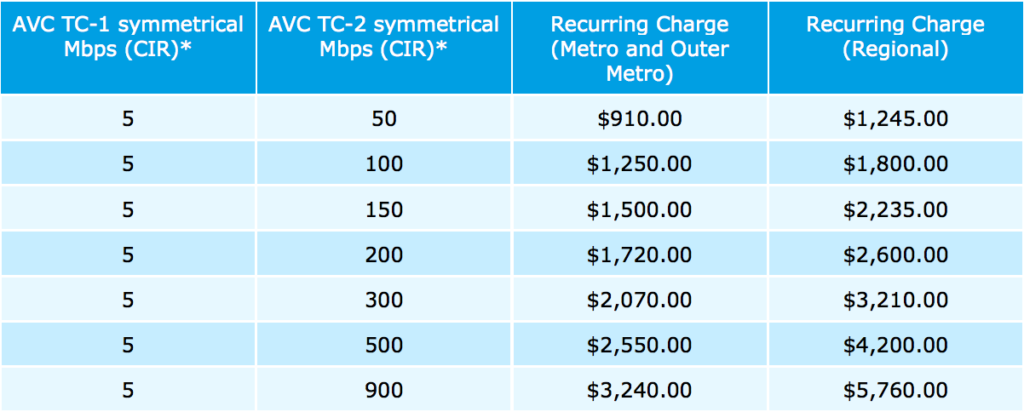

This means, to even consider offering gigabit plans, a provider must have enough customers at each point of interconnect to need at least 1Gbps of CVC… which comes in at $17,500 ($17.50 per Mbps before GST).

NBN will soon be introducing dimension-based discounts which will give more generous CVC discounts to providers who buy more CVC on a per-user basis, but it still puts 1Gbps residential plans in the realm of impossibility.

Let me be clear —it’s not that there’s no demand for gigabit plans in the residential market. It is that it is too cost prohibitive and far too risky for providers to offer gigabit services to consumers due to the NBN CVC pricing model.

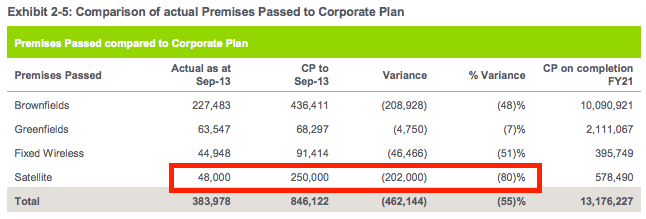

Under the current pricing model, which to be fair to the current Government, was brought in when the NBN was first introduced by Labor… the NBN rollout must reach critical mass at each point of interconnect and have a significantly reduced cost per Mbps for CVC in order for NBN plans with speeds higher than 100Mbps to start showing up.

Providers overseas, for example AT&T, are offering gigabit services at USD$70 which converts to around AUD$100. With the current CVC model at an arguably high 1:100 contention ration (i.e. 10Mbps of CVC allocated for a 1Gbps connection), NBN costs alone would be over $300. That doesn’t even include interconnection, peering or backhaul costs.

I’ve argued in the past for a different style of dimension-based CVC pricing, where a proportional CVC contribution is paid per end user to make up for the revenue. In turn, NBN will manage the contention.

This would allow providers to offer 1Gbps plans to consumers before the rollout reaches critical mass, and increase the short term revenue for the project if there are more users who take up higher speeds. But such a radical change can’t happen without substantial industry consultation.

Regardless, it is a self-fulling prophecy to say that “there is no demand for gigabit services” when in fact the NBN pricing model is designed to prohibit gigabit services for residential connections.

^ effectively all customers serviced from the same NBN point of interconnect. There are limitations to how many users can be placed on a single CVC and which technologies can share a common CVC, but for all intents and purposes — this is irrelevant for this discussion.

Where’s the demand?

Even if the pricing issue is tacked… you might ask — why would there be demand for gigabit services? QHD content on Netflix only utilises 25Mbps of bandwidth; what applications possibly require more than that? While I can’t possibly accurately predict future applications, there is one obvious demand for high speed: productivity.

As “cloud” storage and computing becomes more and more widely used, there is increased need for burstable Internet connections. As a budding geospatial geek, say I need to transfer a large dataset from my computer to a cloud processing service (conceptually, backing up a large number of photos or videos to cloud storage would be an identical situation).

It would take me no less than 12 hours to transfer a 500GB raster dataset over a 100Mbps connection to my remote server. With a 1Gbps connection, this would reduce to just over an hour.

In this example — I don’t necessarily need the 1Gbps at all time. Perhaps on average, I need no more than a 25Mbps connection. But the productivity gains in having a burstable connection that can reach gigabit speeds when I need it to can be enormous. Rather than sitting and twiddling my thumbs for half a day to wait for my data to be uploaded, and another 12 hours to download it again, I can save some 20-22 hours all up simply by having the connection “on standby” (so to speak).

Infrastructure networks are rarely designed on an “average consumption” basis. If roads and highways, or water and power infrastructure were designed on what happens on “average”, traffic congestion, blackouts and water shortage would be a common problem during peak times.

Good power infrastructure, for example, is designed to cope with sudden demands for electricity. There is phenomena known as “TV Pickup” in the United Kingdom where there is a sudden increase in electricity demand during TV ad breaks — thanks to a large number of people simultaneously turning on the kettle across the UK.

Final words

So, this isn’t simple demand and supply here. Demand is not only driven by users… it is also a function of the NBN’s price structure.

The fact of the matter is, there is far more to the lack of gigabit services than meets the eye initially.

If we are indeed serious about the innovation nation, I call on both side of politics to put down their swords and look seriously at pricing reform for the CVC. I seriously hope for some bipartisanship… if not at the technology front, then certainly at the pricing policy front.