Geospatial analysis of the daily Qantas flight paths and NBN satellite beam coverage shows how NBN’s satellite network could be affected.

Qantas has recently announced that it plans to offer a Wi-Fi service on board its A330 and Boeing 737 fleet from early 2017 by utilising capacity on NBN’s recently launched Sky Muster satellite. However, many Australians living in rural and regional Australia have raised concerns that the Qantas service will cause further congestion on an already limited service.

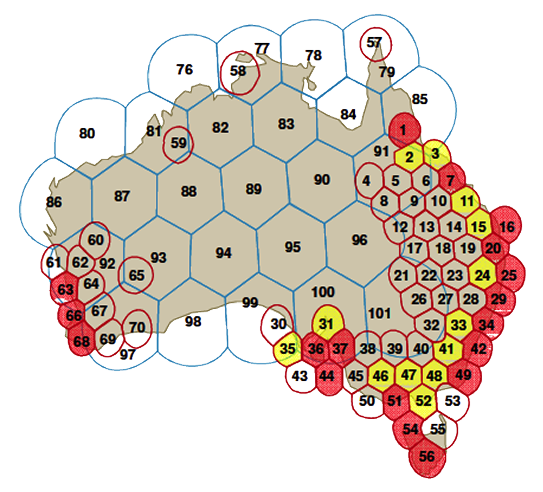

The company responsible for building the National Broadband Network, nbn, had completed a review of satellite capacity in its Fixed Wireless and Satellite review where it identified 31 beams around Australia that would be oversubscribed or severely oversubscribed once a take-up rate of 65% is reached. As a result, the company will introduce strict Fair Use policies to significantly limit the amount of data to 150 GB (priced at a premium) that can be used by each customer on a 4-week rolling average basis.

Consequently, the Qantas announcement has infuriated many who are within the satellite footprint. Analysis of flight paths taken by Qantas’ domestic flights using their A330-200, A330-300 and Boeing 737-800 fleets show that all planes fly through at least one congested or severely congested satellite beam.

Key findings:

- 334 Qantas domestic flights utilise the A330-200, A330-300 and Boeing 737-800 fleet on the day analysed.

- Every flight flew under at least one oversubscribed or severely oversubscribed beam.

- 58% of oversubscribed or severely oversubscribed beams will have minimal impact, with at most 2 planes flying under the beam at any given time.

- The Sydney-Brisbane and Sydney-Gold Coast routes travel entirely within severely oversubscribed NBN Satellite beams (34, 29, 25, 20).

- The Sydney-Melbourne, Melbourne-Canberra, Sydney-Canberra and Townsville-Brisbane routes travel entirely within oversubscribed OR severely oversubscribed NBN Satellite beams.

Analysis: by congested beams

Over half (58%) of congested beams are not affected or are minimally affected by Qantas planes. Of the 31 beams considered oversubscribed or severely oversubscribed, 5 of them do not cover any current eligible Qantas flight paths. 7 beams will have at least one flight under the path at some point, and 6 beams will have up to 2 flights under it at the same time (within a 10 minute time frame).

Unsurprisingly however, the beams covering areas immediately surrounding capital cities will have the greatest number of flights under it at any given time:

- Beam 42 (Sydney Beam) is the worst affected, with up to 7 Qantas flights within a 10 minute time frame travelling under it.

- Beams 47 (Melbourne Beam) and 20 (Brisbane Beam) come in second, with up to 6 Qantas flights within a 10 minute time frame travelling directly under each of them.

- Beam 37 (Adelaide Beam) comes in third, with up to 5 Qantas flights within a 10 minute time frame travelling directly under each of them.

It should be noted though, that for the day analysed — the Sydney and Brisbane beams only had the greatest number of flights under it for a single 10 minute time frame (between 8:50am – 9:00am and 7:30pm – 7:40pm respectively).

Finally, by considering the average number of Qantas planes under a beam over a 24 hour period — we see that Beam 47 (Melbourne) tops out at 1.94 planes with Beam 42 (Sydney), Beam 20 (Brisbane) and Beam 41 (Canberra) following closely behind at 1.52, 1.45 and 1.22 planes respectively.

| Beam* | Max concurrent flights under beam (over 10 min period) |

%age of time with at max plane under beam |

%age of time with at least one plane under beam |

Avg. number of planes under beam over 24 hrs |

|---|---|---|---|---|

| 47 (Melbourne) | 6 | 2% | 67% | 1.94 |

| 42 (Sydney) | 7 | 1% | 63% | 1.52 |

| 20 (Brisbane) | 6 | 1% | 63% | 1.45 |

| 41 (Canberra) | 4 | 5% | 58% | 1.22 |

| 37 (Adelaide) | 5 | 1% | 49% | 0.86 |

| 24 (Armidale) | 5 | 1% | 53% | 0.83 |

| 48 (Omeo) | 4 | 1% | 51% | 0.76 |

| 66 (Perth) | 3 | 1% | 51% | 0.63 |

| 34 (Newcastle) | 3 | 3% | 40% | 0.57 |

| 33 (Bathurst) | 4 | 1% | 33% | 0.48 |

| 25 (Grafton) | 2 | 3% | 33% | 0.37 |

| 46 (Ararat) | 3 | 1% | 28% | 0.36 |

| 3 (Townsville) | 2 | 3% | 28% | 0.31 |

| 15 (Wondai) | 3 | 1% | 24% | 0.30 |

| 29 (Port Macquarie) | 2 | 1% | 26% | 0.27 |

| 36 (Yorketown) | 3 | 1% | 22% | 0.26 |

| 35 (Port Lincoln) | 2 | 2% | 22% | 0.24 |

| 7 (Mackay) | 2 | 3% | 19% | 0.22 |

| 11 (Rockhampton) | 2 | 2% | 20% | 0.22 |

| 31 (Whyalla) | 1 | 15% | 15% | 0.15 |

| 44 (Kangaroo Island) | 1 | 8% | 8% | 0.08 |

| 63 (Guilderton) | 1 | 8% | 8% | 0.08 |

| 16 (Maryborough) | 1 | 6% | 6% | 0.06 |

| 2 (Charters Towers) | 1 | 3% | 3% | 0.03 |

| 1 (Cairns) | 1 | 3% | 3% | 0.03 |

| 51 (Geelong) | 1 | 2% | 2% | 0.02 |

| 49 (Bega) | 0 | 0% | 0% | 0.00 |

| 52 (Inverloch) | 0 | 0% | 0% | 0.00 |

| 54 (Burnie) | 0 | 0% | 0% | 0.00 |

| 56 (Hobart) | 0 | 0% | 0% | 0.00 |

| 68 (Bridgetown) | 0 | 0% | 0% | 0.00 |

* Beam name is based on a suburb/town/city directly under the beam and may not be the official name used by nbn

Analysis: by flight

Each flight and its flight path were analysed to see which NBN Satellite beam it flies under. The results shows that every single Domestic Qantas A330 and B737 flight flies under at least one oversubscribed or severely oversubscribed satellite beam.

The most prominent are the Sydney-Brisbane and Sydney-Gold Coast routes, which flies entirely within severely oversubscribed beams (that’s beams 34, 29, 25, 20). Sydney-Melbourne, Melbourne-Canberra, Sydney-Canberra and Townsville-Brisbane routes fly entirely through oversubscribed or severely oversubscribed beams.

For the full analysis output, click here!

Concluding thoughts…

I find the results of this analysis somewhat inconclusive. Firstly, unlike domestic US services — the number of Qantas flights expected to get the Wi-Fi service is quite small.

With under 350 flights spread out geographically and over a 24 hour period, I doubt the planes would have a material effect on congestion. Currently, the worst case scenario seems to be up 6-7 planes flying under a single beam at any given time. However, in the case of the 7-plane statistic, it happens only once in a 24 hour period. The speed at which planes travel also mean that they will typically fly in and out of narrow beams within 10-15 minutes, meaning any impact should be distributed across multiple beams as the plane flies through the airspace.

On the other hand, the bulk of the flights will fly under already oversubscribed areas. This is especially true for the beams serving the areas immediately surrounding the capital cities, which are all severely oversubscribed (bar-Darwin). These areas also have the greatest number of concurrent flights, represented by the “average number of planes over 24 hours” statistic.

So, no. I don’t think there’s an immediate threat to congestion. However, it does set a precedent. If more carriers get on board… and if international flights get added to the pool as well — things could well change in the future.

Assumptions made in this analysis:

- The flight data analysed was from Wednesday, 23rd Feb 2016.

- Qantas will only install the Satellite-powered Wi-Fi solution on their A330-200, A330-300 and Boeing 737-800 fleet.

- In all cases where the plane transverses an area with both a wide and narrow beam, the congested, narrow beam is selected.

- Plane locations are calculated in 10 minute intervals.

- Congestion (oversubscribed beams) are based on results in the NBN Fixed Wireless and Satellite Review.