nbn has strongly refuted suggestions that their node’s backhaul link is already hitting capacity, and figures seem to match their assertion.

(analysis) The company responsible for building the National Broadband Network, nbn, has refuted claims that backhaul congestion is the primary cause of slow speeds experienced by users on its recently-launched Fibre to the Node network. As a matter of distinction, this is separate from the blog post I wrote 7 months ago about long-term capacity challenges faced by nbn. In this post, we are discussing congestion issues faced by current customers.

If we examine the figures closely, there simply isn’t enough customers on each node (yet) to need to worry about backhaul congestion yet. In raw numbers, the lucky chaps in Belmont North connected to node 10 in Belmont 7 (2BLT-07-10) had just a smidgen under 100 premises connected at the start of this month. This is followed closely by node 5 in Belmont 5 and node 2 in Belmont 1 in the raw take-up of high 80s.

| Node (ADA) ID | Node premises count | Currently active premises |

|---|---|---|

| 2BLT-07-10 | 233 | 93 |

| 2BLT-05-05 | 247 | 88 |

| 2BLT-01-02 | 226 | 84 |

| 2GRK-02-11 | 273 | 83 |

| 2BLT-10-08 | 246 | 82 |

| 2BLT-07-07 | 210 | 81 |

| 2BLT-07-17 | 233 | 80 |

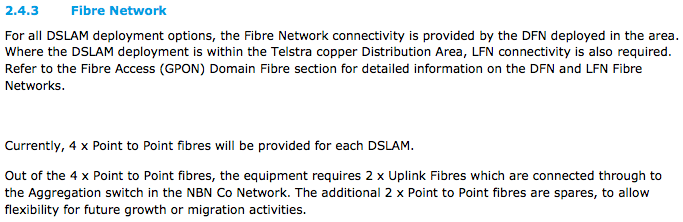

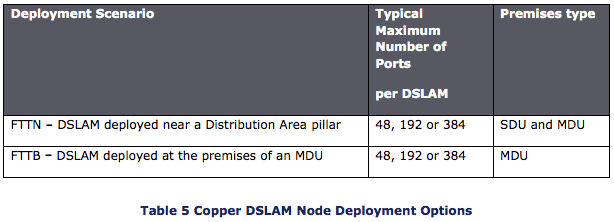

If we consider the FTTN AVC profile revealed in estimates (13% on 12/1 Mbps, 50% on 25/5 Mbps, 25% on 50/20 Mbps and 12% on 100/40 Mbps), we can consider an aggregate average downlink AVC of roughly 39 Mbps per FTTN user. At roughly 100 per node sharing 1GE uplink fibre, even during full saturation — each user would get on average an uncontended 10 Mbps link. That’s better than a 1:4 contention ratio — well above most, if not all, residential-grade services.

Of course, I’m not privy to NBN’s network utilisation graphs. But I’m fairly confident that they will show in each node, there is currently plenty of buffer space.

As I’ve said in an earlier blog post, node-based congestion can really only be expected during peak times on a fully loaded node. Without wider saturation of 4K TVs at this point in time, the entire neighborhood of 100 premises must stream at least 2 HD Netflix or YouTube video simultaneously before there starts to be congestion issues — a virtually impossible scenario.

We don’t know what may happen in the future. Perhaps when 4K becomes more mainstream, it will become an issue. The scenario I posed was 25% of customers simultaneously streaming 4K is all it would take to congest a full loaded node. But at least for now, it’s pretty safe to say that this particular factor is not major concern.

So if it’s not node backhaul, what is it?

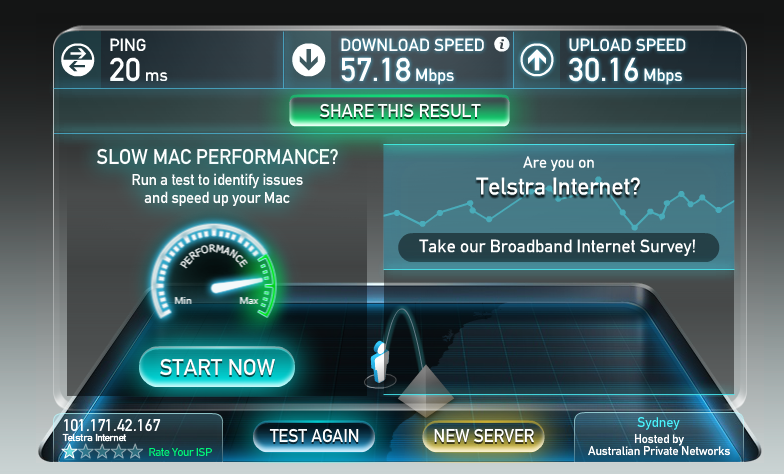

It must suck to be in this situation currently. When you have end users posting speed tests well below 10 Mbps download “consistently”, you know there is an issue somewhere. Whether it’s a sync speed issue, CVC underprovisioning, packets being dropped by nbn somewhere within the network or something else altogether — testimony given by CEO Bill Morrow at the recent Senate Estimates suggests that nbn and service providers are working through it bit by bit to diagnose. One thing’s for sure, it’s most probably nothing to do with node backhaul congestion yet.